The “HATARAKU Fund” aims to create diverse ways of working and living,

and expand mechanisms to support workers

Case studies

This is an impact investing fund open to external investors that was established as a joint effort between Japanese banking groups and SIIF. It seeks to mitigate the aging of the population, declining birth rates, and shrinking working population through the creation of diverse ways of working and living.

Impact investing

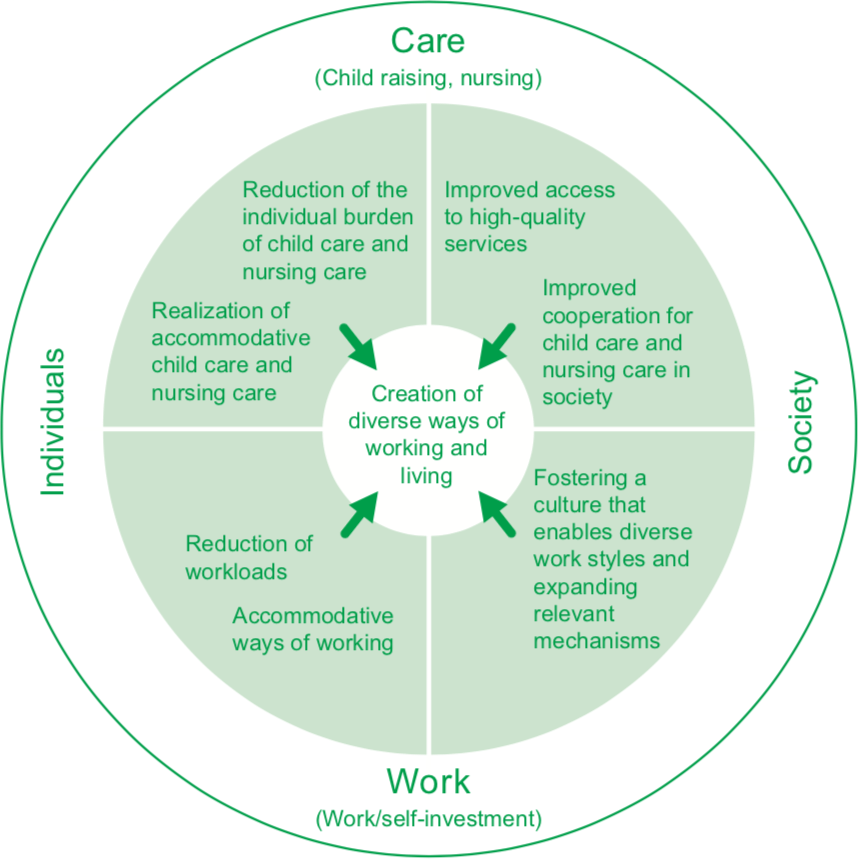

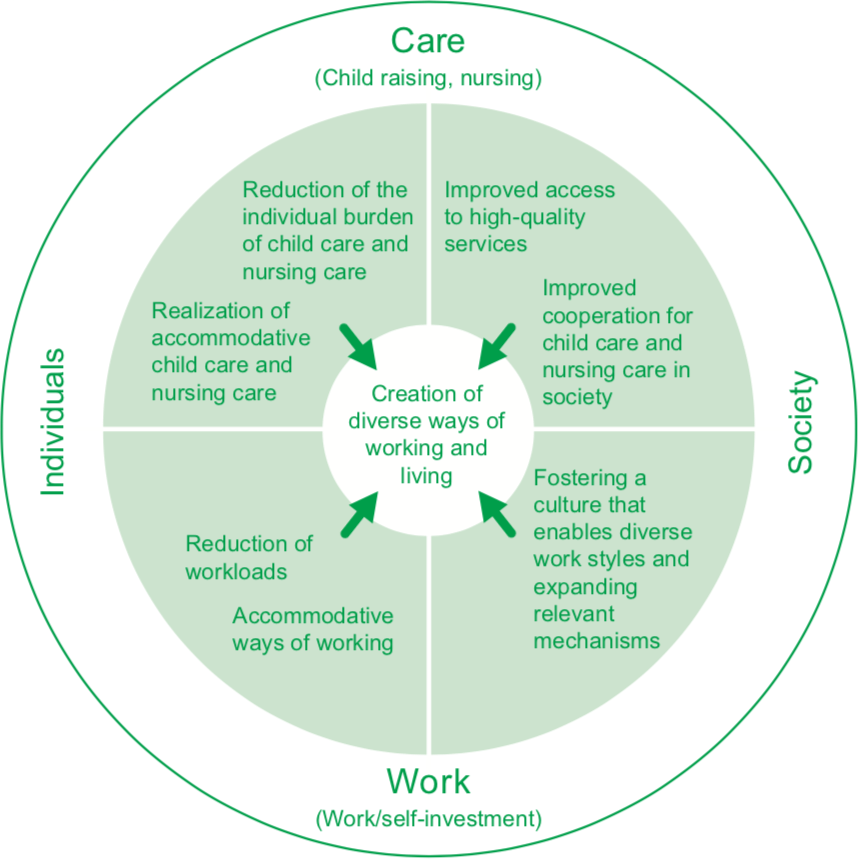

The “HATARAKU Fund” was established in a joint effort between Japanese banking groups and SIIF, as one of the few examples in Japan of an impact investing fund that is open to external investors. With a focus on pressing social problems such as the declining birthrate and the aging population, this is a fund to invest in companies that create the environment required to enable working people to continue to work through a variety of life events. Having designated the creation of diverse ways of working and living as targeted long-term social changes (impacts), the fund invests in the work domain in areas such as care, including child raising and nursing, and in the nurturing of next-generation human resources, in order to build more substantial mechanisms for supporting working people in society.

Theory of Change (ToC) for this fund

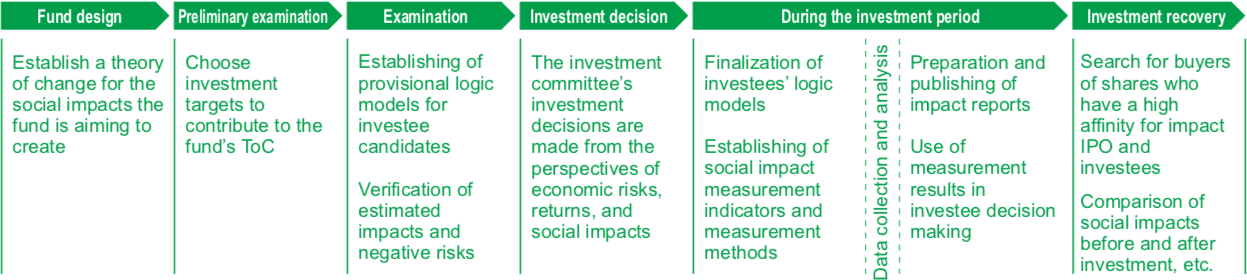

Measurement process for this fund

Introduction to investees

- BPO Technology Inc.

-

Our vision is “to make online assistant services commonplace in Japan. Fujiko-San” is a service that provides online assistants to take care of back-office tasks. We aim to increase people’s time and happiness by working to solve social issues such as resolving labor shortages in companies, promoting DX, and creating opportunities for people with limited employment opportunities, while exploring the optimal teamwork between humans and AI.

- Antway Co., Ltd

-

With the mission of “Taking Obligation Away from Every Household “, Antway operates “Tsukurioki.jp,” a home-cooked meal delivery service that weekly delivers handmade deli with more than 1,000 recipes. The company aims to bring about the realization of equal opportunity both in career and personal life in Japanese society regardless of gender, where excessive burden of unpaid domestic work by women still persists.

- CaiTech inc.

-

We develop and operate the “Cai-suke”, a work-sharing online platform for nursing care, that matches “unoccupied time” of qualified caregivers and the “nursing care work” of nursing care facilities suffering from a shortage of human resources. The “Cai-suke” platform contributes to solving the shortage of qualified caregivers and improving the operations of nursing care facilities, and thereby leads to a successful transition of Japan to a super-ageing society.

- Compass, Inc.

-

Our mission is to “eliminate the working poor from Japan”. We solve the problems of the local labor market with consultation and technology. Our service is characterized by the flexibility in which ”anyone can consult with us at any time and from anywhere”, and 10,000 people have used our service so far.

- Linc, Inc.

-

We seamlessly support people from overseas throughout the period of studying and working, and provide them with happiness and opportunities to learn and work in Japan. We aim to create a more diverse and inclusive society by bridging between Japan and people from overseas, and by bringing innovation to the declining birthrate and employment structure.

- CureApp, Inc.

-

CureApp, Inc. is a medtech startup that conducts research and development and manufactures and distributes software medical devices. They focus on the development of Therapeutic Apps that realize the new medical concept of applying advanced software technology and medical evidence to treat diseases.

- YeLL, Inc.

-

In order to increase the engagement of workers in Japanese society, Yale provides “YeLL,” an online 1-on-1 (one-on-one interview) service that supports organizational change, and “YeLL|Listen Training,” an online training program for improving 1-on-1 skills. Through improving the psychological safety of organizations, we aim to achieve both individual happiness and corporate value enhancement.

- Life is Tech, Inc.

-

Our mission is to stretch the possibilities for each and every junior and senior high school student to the maximum extent possible. Rather than simply enabling such students to acquire programming knowledge and skills, we provide an IT programming education that emphasizes creation of the abilities that will be needed by the people who will lead the process of resolving social problems.

- UniFa Inc.

-

Our organizational purpose is to create new social infrastructure around the world that realizes the dreams of families, and we use cutting-edge technologies such as AI and IoT to improve the working environment in childcare facilities and to raise the quality of childcare itself. We aim to achieve a more prosperous society and to contribute to the SDGs.