SIIFIC Wellness Fund intending to fundamentally solve social issues. Case studies

Impact investment fund established by SIIF for wellness:Let’s all live a better life through learning together and acting on our own.

Impact investing

The SIIFIC Wellness Fund was established in collaboration with SIIF and SIIF Impact Capital as an impact investment fund in which external investors also participate, intending to provide fundamental solutions to social issues in wellness.

Wellness is an attitude for living a better life.

We believe that it has never been more important to shift from “quantity” health (mere extending life expectancy) to “quality” health (activeness, self-determination, and positive lifestyle) in a country like Japan where the population is aging at the speed highest in the world,

Put another way, it matters to shift to a society where people can work on their own wellness: to the wellness paradigm.

People with high wellness literacy can access to and evaluate health information, make appropriate decisions about their own health, and take actions to live better.

People with rich social capital can enjoy the support from their family, friends, and community, and have easier access to health information and resources. Besides it, these people can utilize their social networks to check the reliability and usefulness of information.

We believe that wellness literacy and social capital complement each other, and that high wellness literacy and rich social capital are quintessential factors for each and every person to live better.

We set it as our long-term goal of social change (impact) to create “a society where everyone is empowered live better”. To that end, we strive to highten wellness literacy and enrich social capital through our portfolio investees.

- ■What SIIF intends to achieve

-

The impact investment assets under management amount up to US$1,164 billion worldwide and \5,848 billion in Japan in 2022. These figures have been showing rapid growth to date with new diverse participants entering this investing area.

In Japan, however, it’s becoming a major challenge to the development of impact investing that only scarce people can practice impact investing and impact measurement/management (IMM).

To tackle this challenge, SIIF will implement impact investing and IMM with the aim to fundamentally solve social issues leveraging the knowledge and ideas it has developed to date. SIIF also will seek to disseminate the knowledge and insights acquired through actual cases, and to develop and produce people capable of practicing impact investing and IMM. - ■Establishment of SIIF Impact Capital (SIIFIC)

~SIIF Impact Capital (SIIFIC) established in September 2022~ -

In September 2022, SIIF established SIIF Impact Capital Corporation (SIIFIC) as part of its efforts to penetrate the ‘methods’ of impact investing and to induce ‘structural solutions to social issues (system change)’, by not only increasing the amount of funds but by actually implementing the methods.

- ■Background of the establishment of SIIFIC Wellness Fund

~Are people becoming happier? Are the planet and the society getting more sustainable?~ -

When looking at social issues, we need to identify the root causes of the complex ‘issues’ that have been embedded in our society, and then to transform social structures rather than just focusing on the superficial visible phenomena.

During the COVID-19 pandemic period, various potential issues facing Japanese society, ranging from aging population to health inequalities by income and region, have become more apparent all at once.

Efforts must be made not only to transform the structure of the health and care institutions and business, but to accelerate the changes simultaneously in individual perceptions and how the mutual assistance is done, while ensuring that no one is left behind from physical, mental and social health.

The SIIFIC Wellness Fund will push forward impact investing through collaboration and co-creation with diverse players with the aim of fundamentally solving social issues facing Japan which is world’s fastest aging society with a super low birthrate. - ■Development process up to fund composition

-

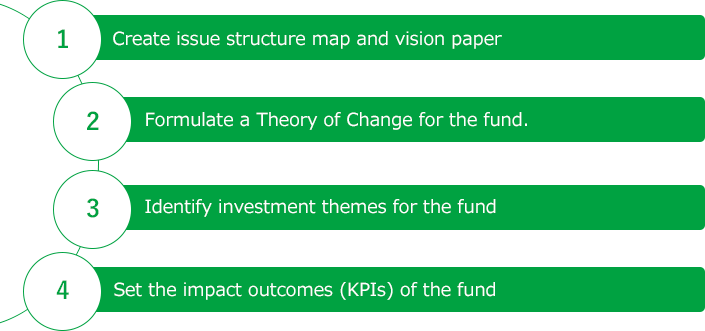

In establishing the SIIFIC Wellness Fund, we took steps of developing and executing the strategy for an impact investing fund.

(1) We SIIF analyzed the structure of issues in the healthcare area and created a vision paper.

(2) After setting it as SIIF’s long-term goal of social change (impact) to create “a society where everyone is empowered live better,” we took time to study and create a theory of change.

(3) Based on the Theory of Change, the investment theme of the SIIFIC Wellness Fund was determined.

(4) We identified the indicators (impact KPIs) for evaluating social changes that we as a fund pursue, with which we are proceeding our investments.

Introduction to investees

- J PHARMA.CO.,LTD as a portfolio company:

-

J Pharma is the only startup in the world conducting clinical trials for LAT1 inhibitors, amino acid transporters that have recently attracted attention as drug discovery targets.

Based on the founder’s philosophy that “we must build a medical system that can continue to give hope to patients with terminal cancer until the end of their life,” J Pharma is conducting the final stage of clinical trials for biliary tract cancer, for which there are still few effective treatments, with the aim of developing an anti-cancer drug with minimal side effects. Through this investment in J Pharma, we will support systemic change in the wellness field.